Particularly in private equity and private finance, if you have been monitoring private markets lately you have most likely seen an increase in evergreen and semi-liquid structures. For good reason, these investment tools are gathering steam. They provide liquidity choices, flexibility, and access not available from conventional closed-end funds. But what's driving this change? And how do these two systems differ? Let's dissect it here.

Evergreen vs Semi-Liquid: What Sets Them Apart?

Initially, some brief definitions. Evergreen funds have no set expiration; they are open-ended. Subject to particular liquidity terms established by the fund, investors can subscribe and redeem continually. These systems let capital be used constantly, therefore lowering the burden on fundraising cycles and exit times.

Conversely, semi-liquid structures land between completely open-ended vehicles and conventional locked-up private funds. They allow regular redemptions, but they sometimes come with liquidity restrictions—that is, gates, notice periods, or limits on how much capital may be taken out at any one moment. Though they are less liquid than public markets, they offer more freedom than conventional 10-year private equity funds.

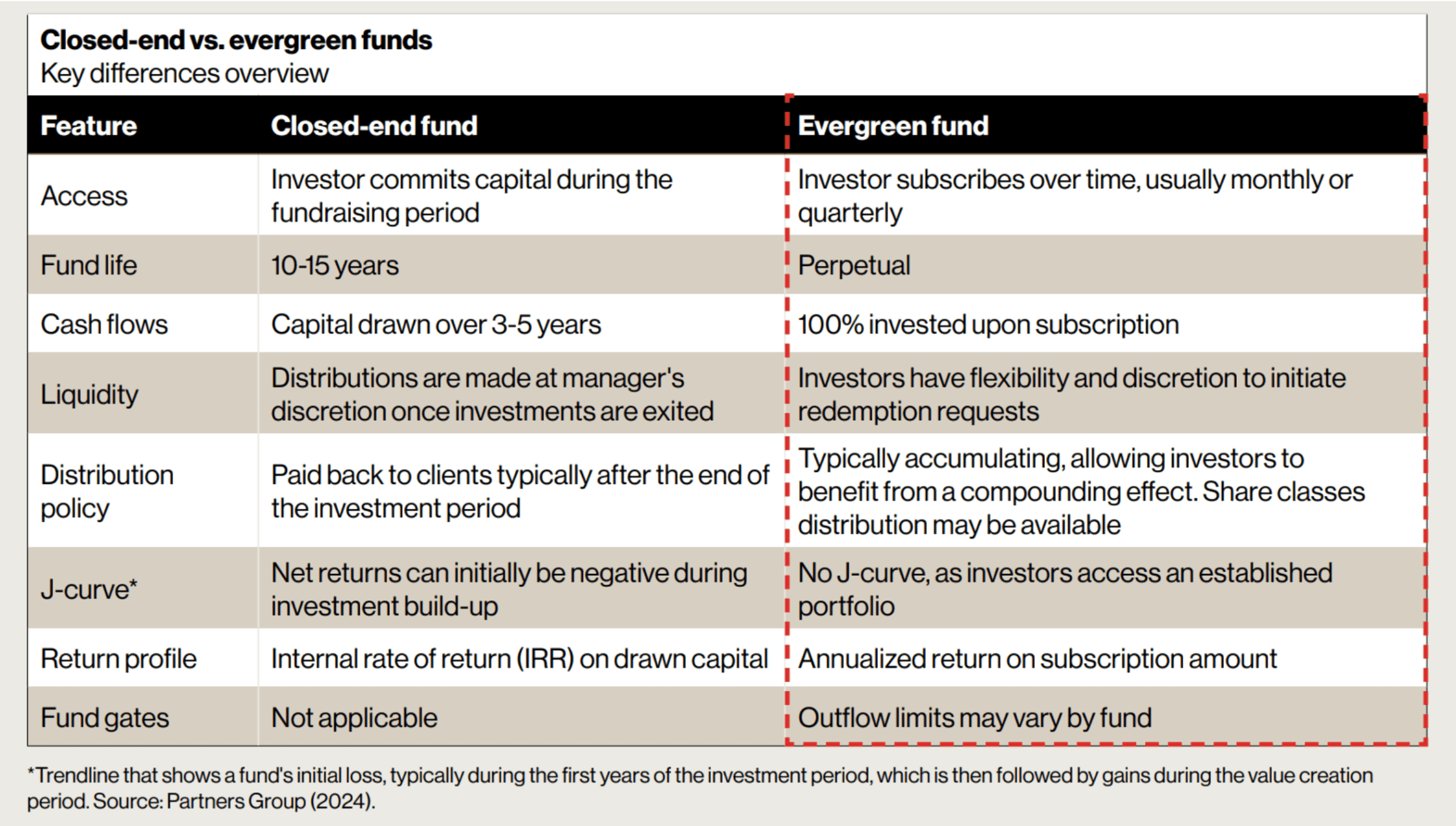

Comparison of traditional closed-end funds vs. evergreen fund structures

Why Are These Structures Growing in Popularity?

A few fundamental factors are driving the change:

1. Investor Demand for Liquidity

Traditional private equity and credit funds are extensively criticized for their long lock-up periods. Institutional and high-net-worth investors increasingly seek access to their money without waiting ten years for distributions. Evergreen and semi-liquid structures satisfy this desire by offering periodic redemption opportunities.

2. Retail and Wealth Management Growth

Historically, private markets were dominated by institutional investors. But the emergence of high-net-worth individuals and family offices seeking alternative investments has forced managers to create structures suitable for these investors, who might not be ready to commit money for ten-plus years.

3. Market Volatility and Economic Uncertainty

As economic cycles become less predictable, investors are seeking strategies to remain adaptable. Semi-liquid and evergreen funds offer a means to maintain some liquidity in case circumstances change while remaining involved in private markets.

4. Operational Efficiencies for Managers

Raising a new private equity fund every few years takes time and money. Evergreen structures allow fund managers to continuously raise and deploy capital without having to go through the fundraising cycle as frequently. This results in more stable capital inflows and benefits long-term planning.

5. Regulatory Changes

Some regulatory reforms have made private markets more accessible to non-institutional investors. For example, changes in rules regarding accredited investors and alternative fund structures have encouraged more innovative fund design.

The Trade-offs

Of course, no structure is perfect. While evergreen and semi-liquid funds offer liquidity, they come with certain potential drawbacks. Liquidity restrictions can still be a challenge during market downturns; fund managers must therefore carefully balance redemptions with ongoing investment commitments. Furthermore, valuation methodologies and pricing transparency are more challenging than traditional buy-and-hold private equity structures.

What's Next?

The rapid growth of these investment vehicles suggests they're more than just a passing trend. As private market access expands and investor preferences evolve, fund structures that prioritize flexibility alongside strong returns will likely inspire further innovation. Whether you're a fund manager considering new structures or an investor exploring private markets, understanding the nuances of evergreen and semi-liquid funds will help you navigate this changing landscape.

One thing is abundantly clear: the private market playbook is changing, and the demand for more flexible investment products isn't slowing down anytime soon.

Explore More